Turning financial tools into growth engines for Deel

—Impact

• Card adoption rose 188 % and active users grew 43 %.

• Revenue from the Deel Card increased 123 % (July 2024 → May 2025).

• Revenue from Deel Advance jumped 229 % in its first six months.

• Churn fell 10 % and 85‑90 % of Advance users returned each month.

• Support tickets dropped noticeably thanks to clearer UI and in‑app guidance.

• Multi‑card creation and the ability to take multiple advances per month unlocked extra spend, contributing an additional 6.5 % of revenue within weeks.

• Laid the foundation for a future cash‑back program and seamless top‑up via Advance, positioning the Card for sustained growth.

—Approach

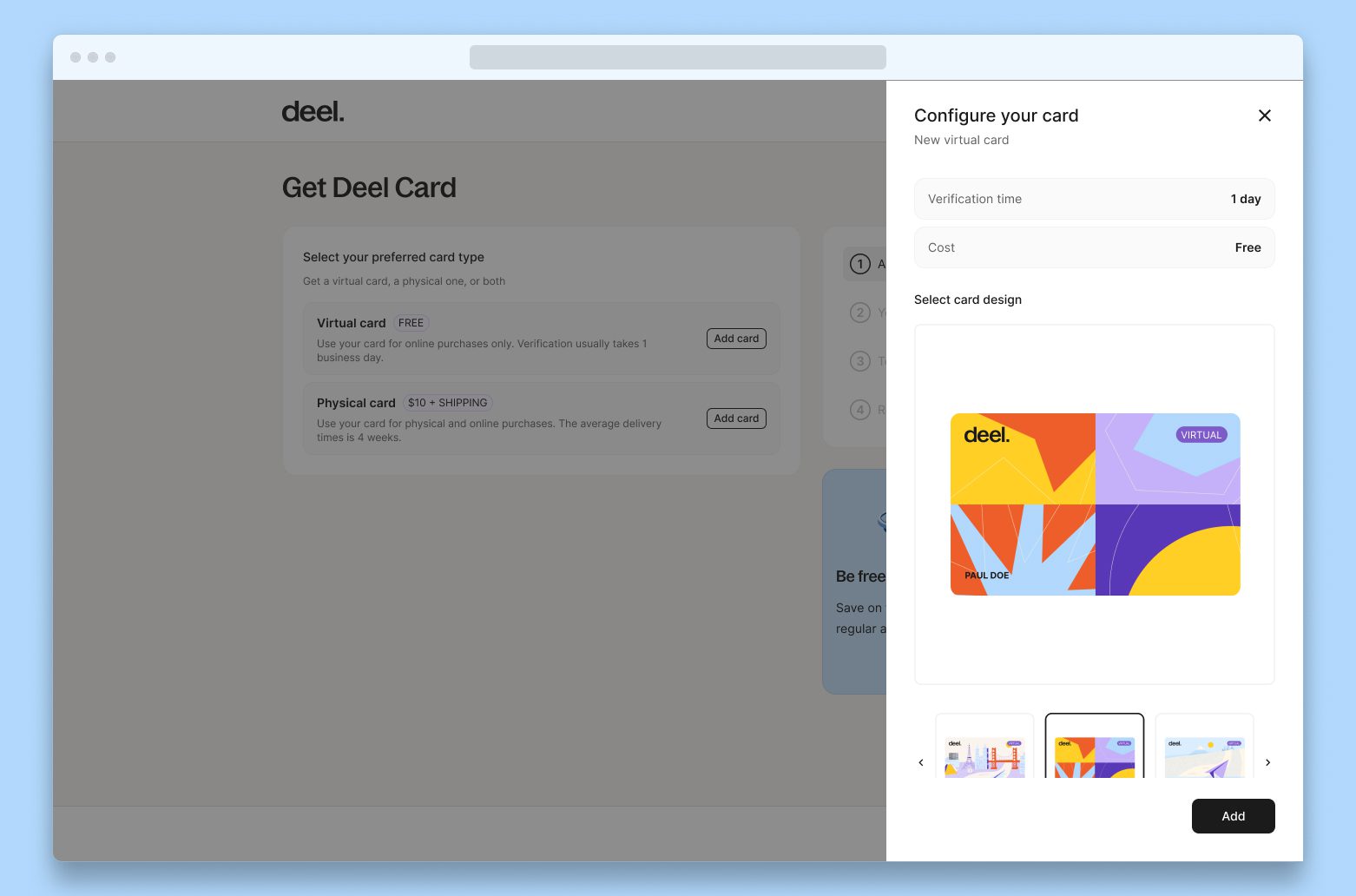

Research for Deel Card revealed four core needs: instant access to funds, clear balance visibility, the ability to manage several cards for different projects, and locally relevant tools. For the Deel Advance, six personas emerged, all sharing a desire for fast, frictionless cash without hidden fees.

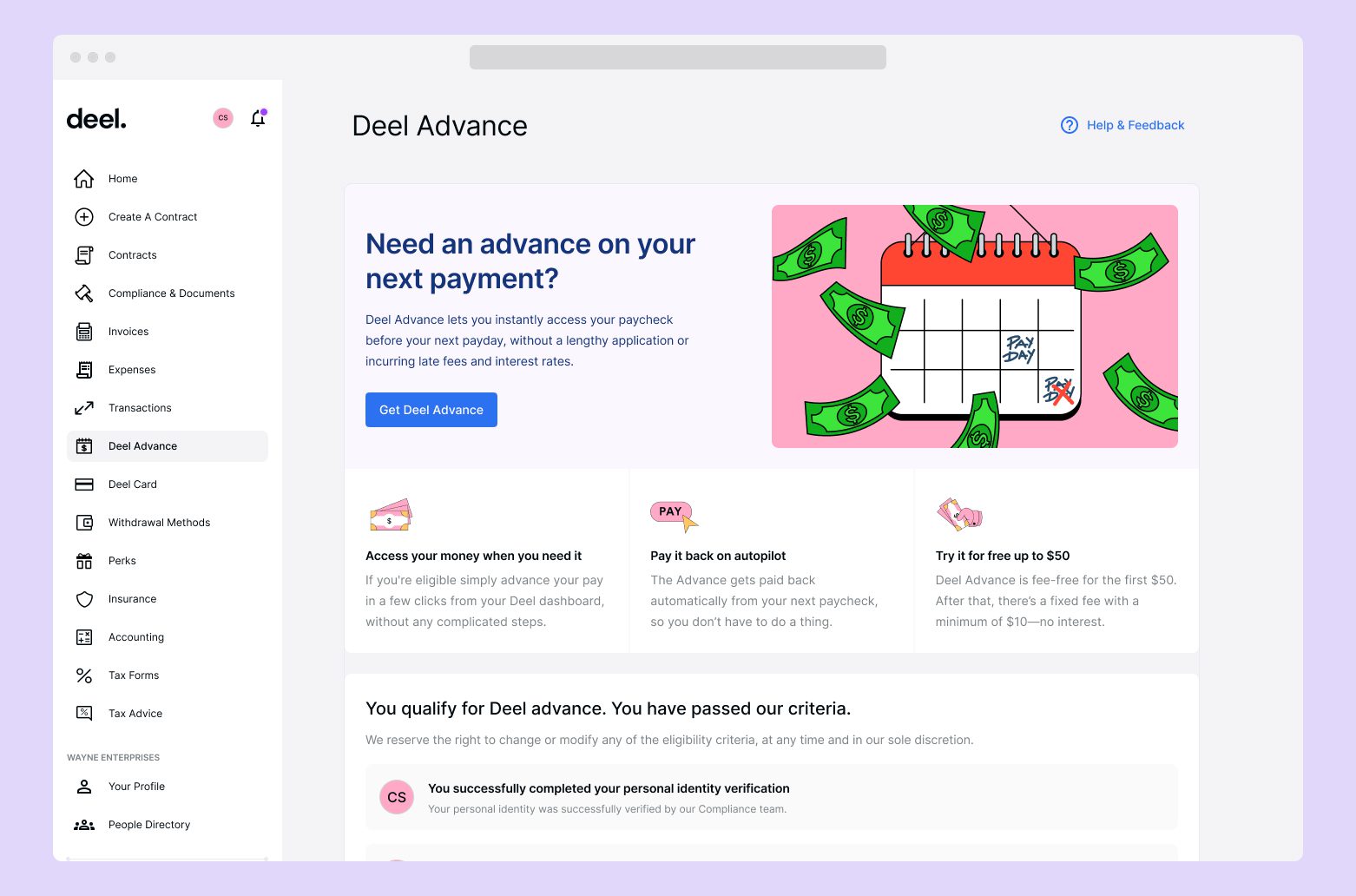

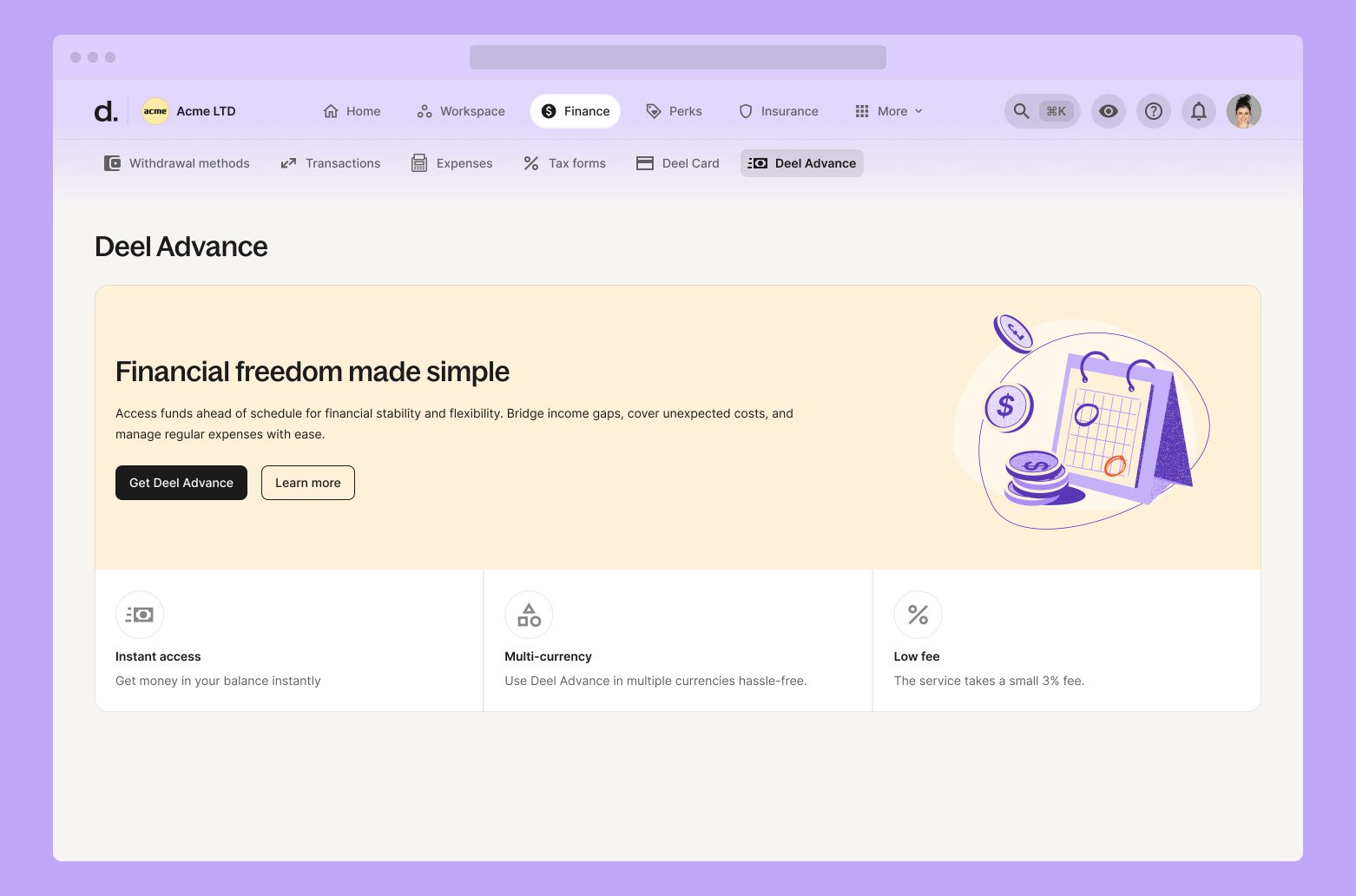

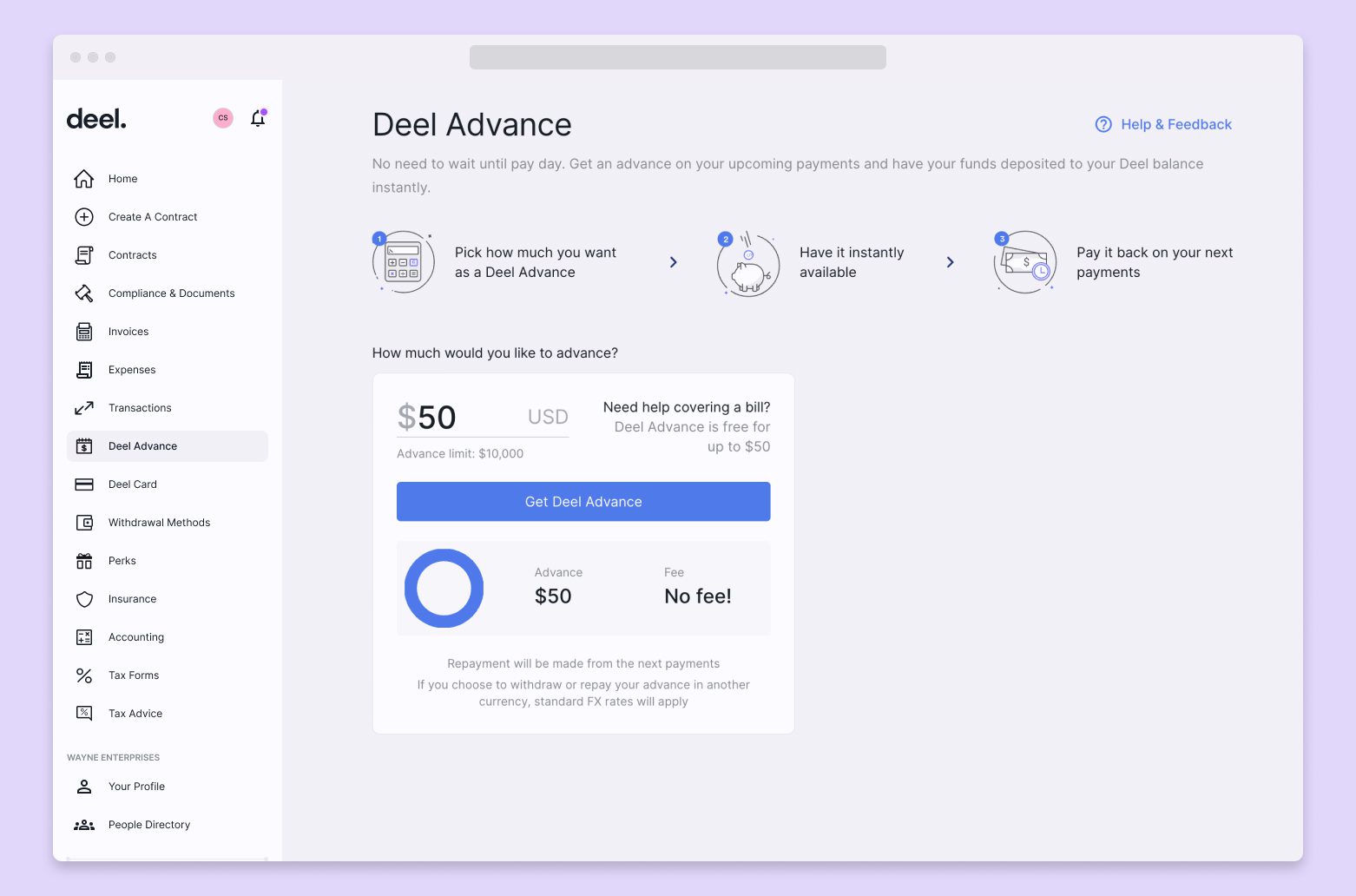

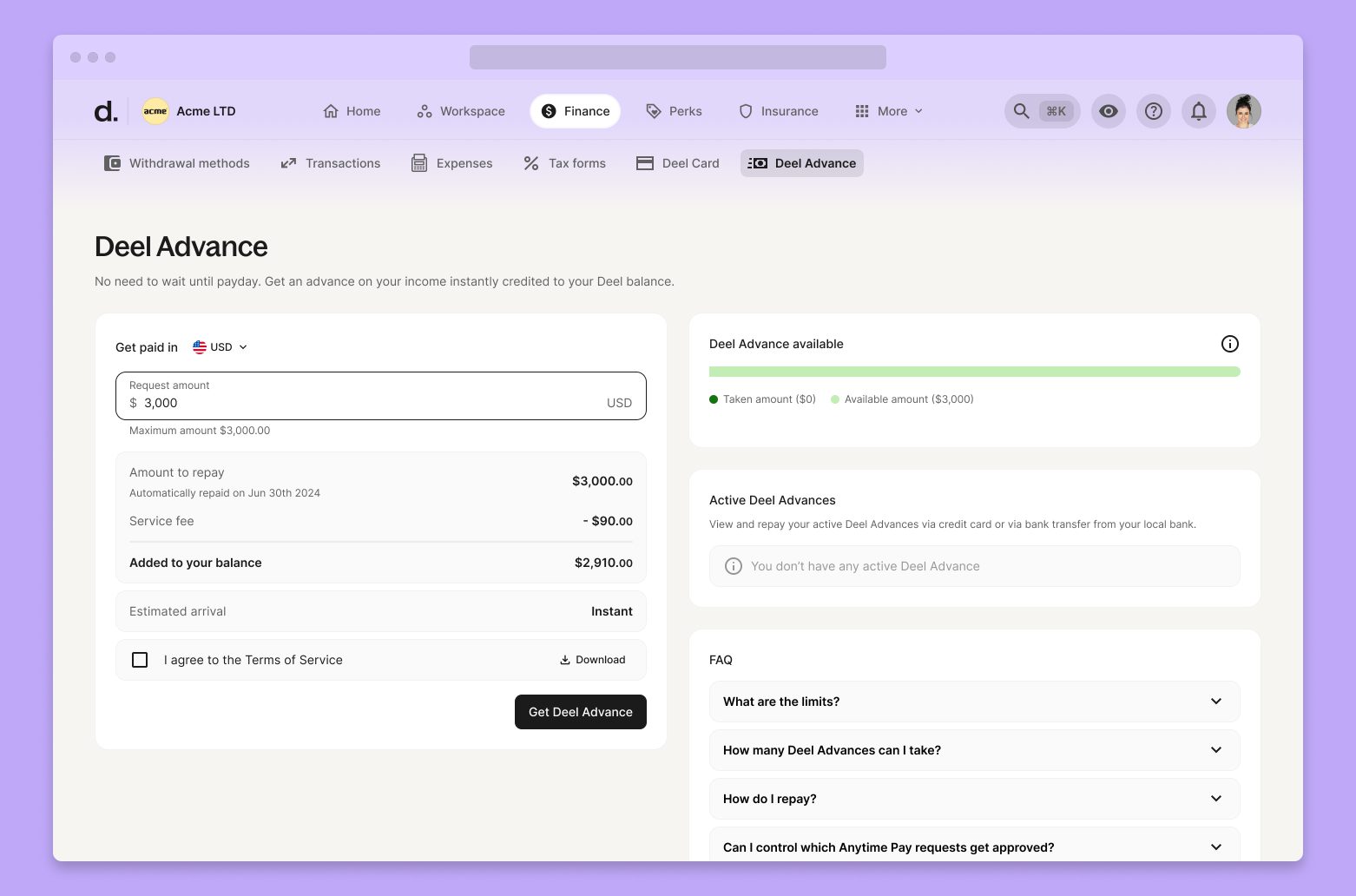

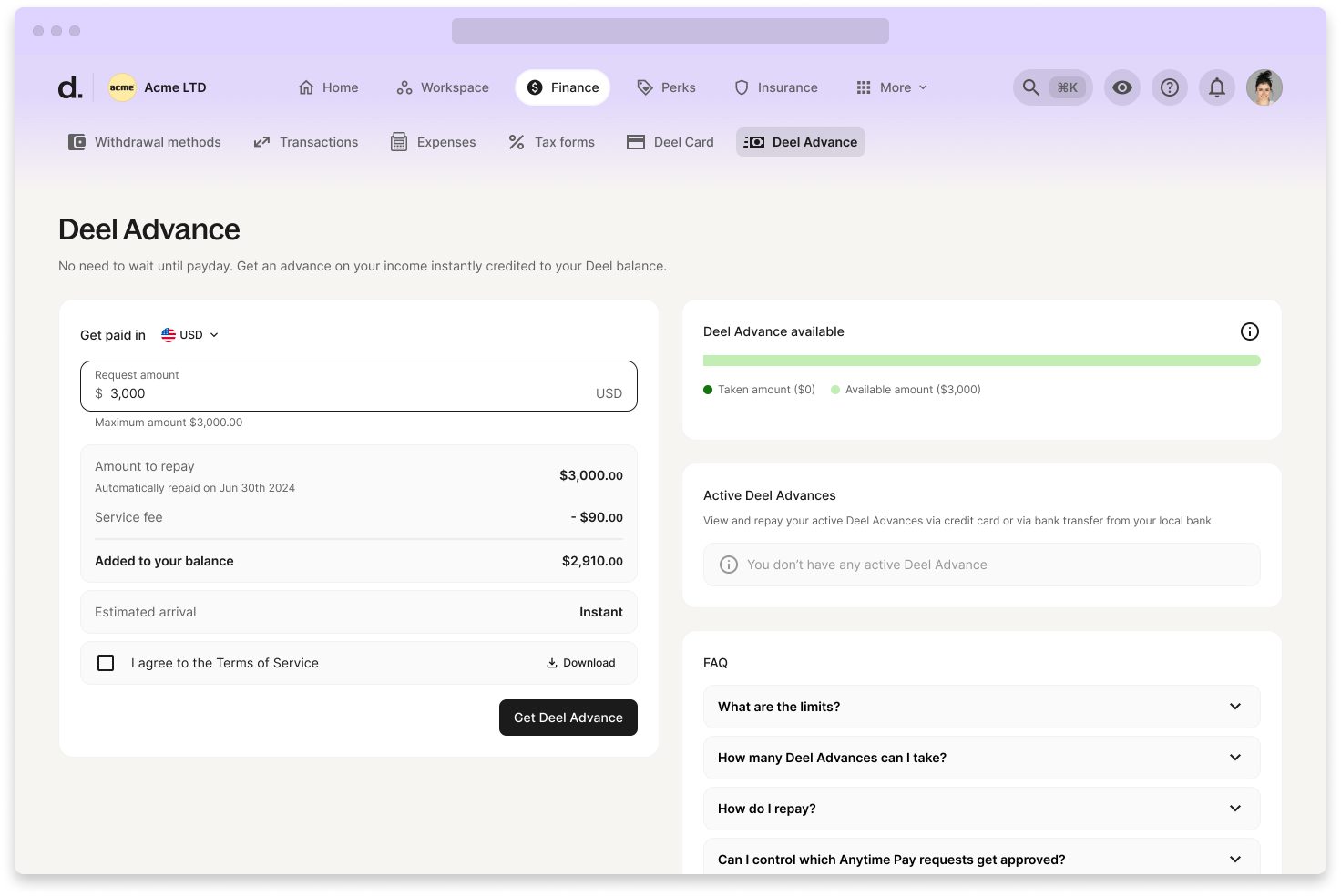

To address these pains, I stripped the Advance flow down to an ATM‑style three‑step process, displayed fees up front, and embedded the option directly inside existing withdrawal flows. This simplification turned a loan‑like experience into a quick cash‑out, raising usage and making the homepage call‑to‑action the top entry point.

Deel Advance screen. Amount input, details, limit, FAQ and T&C all available at one glance

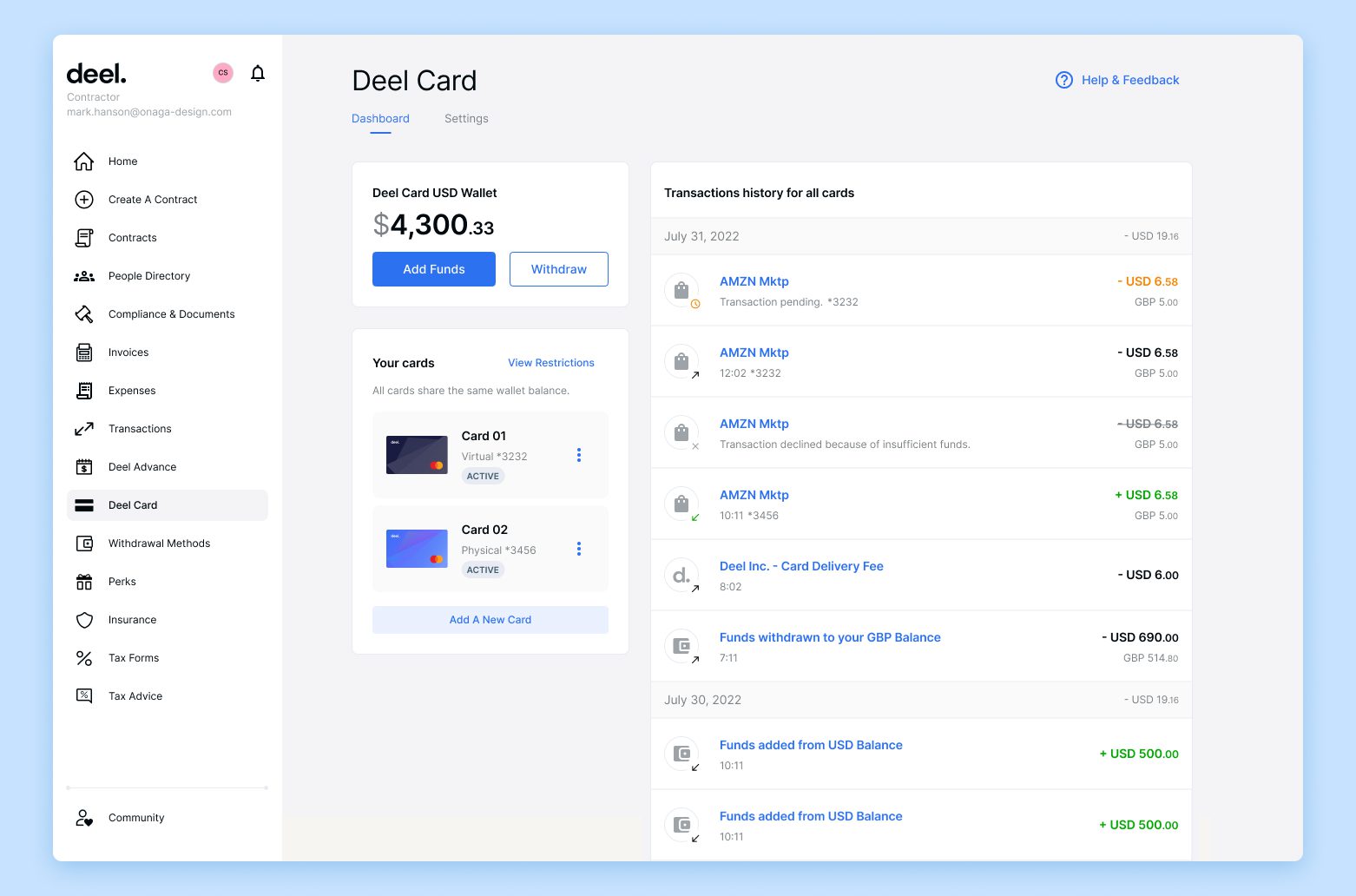

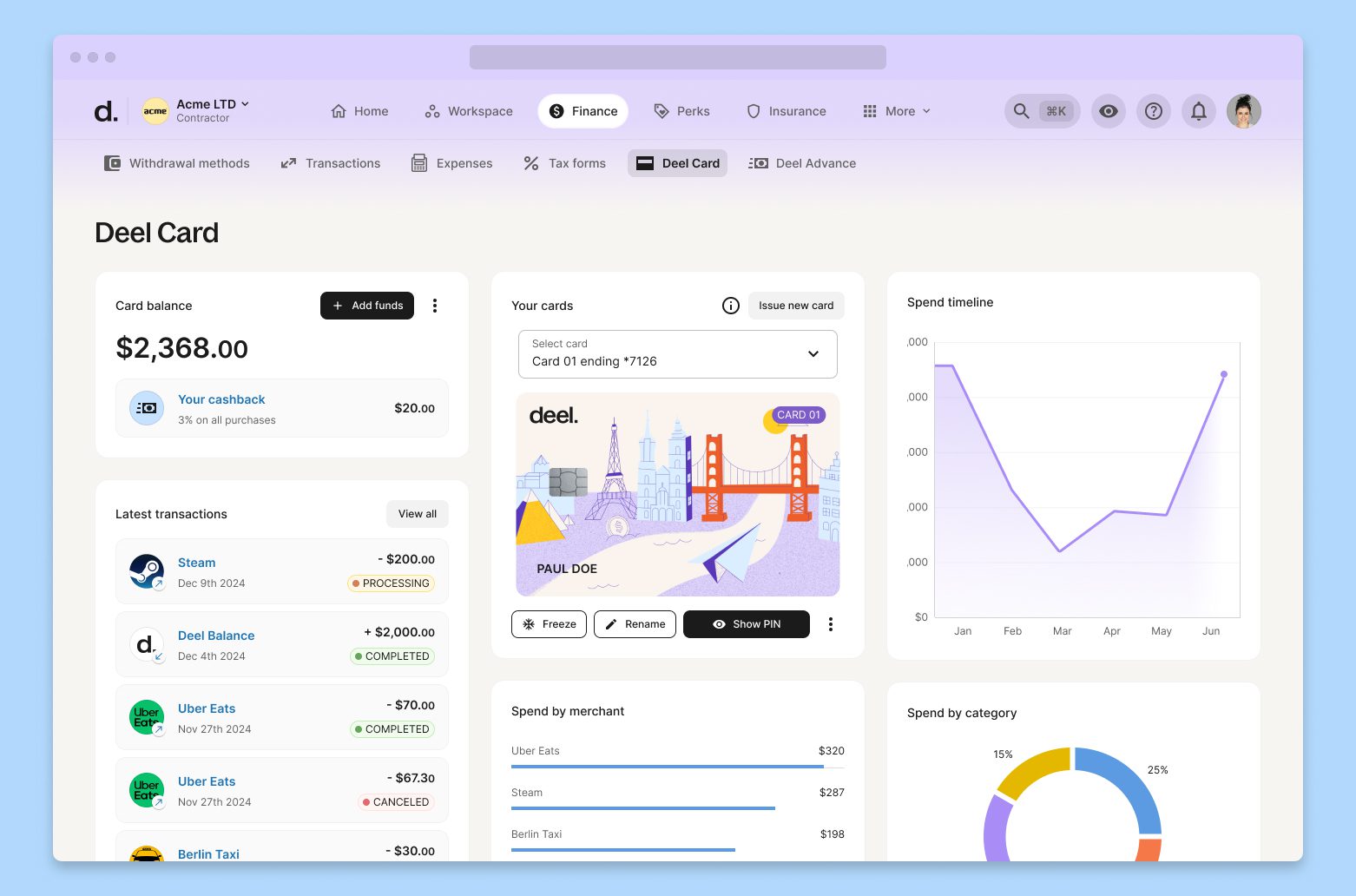

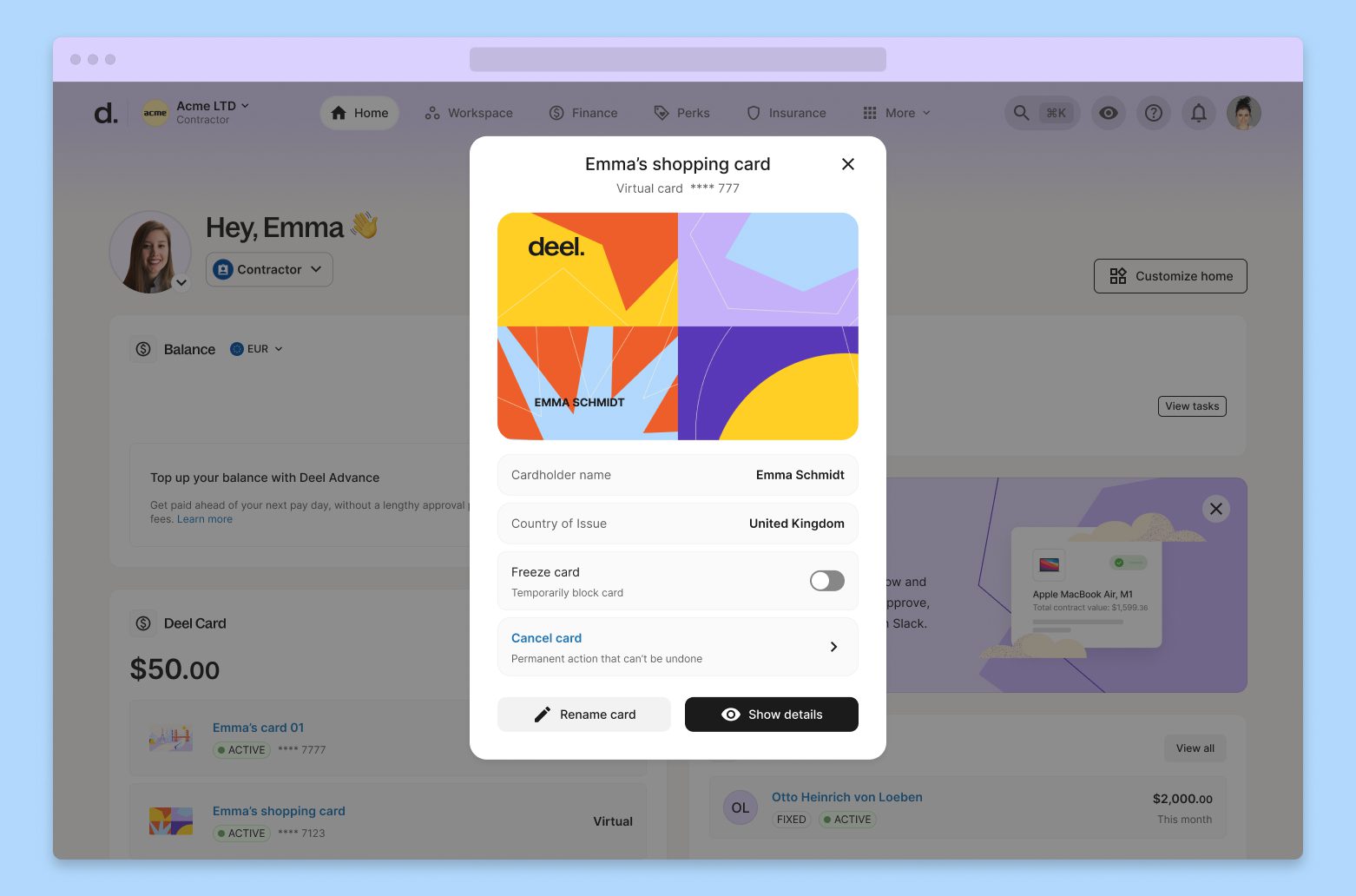

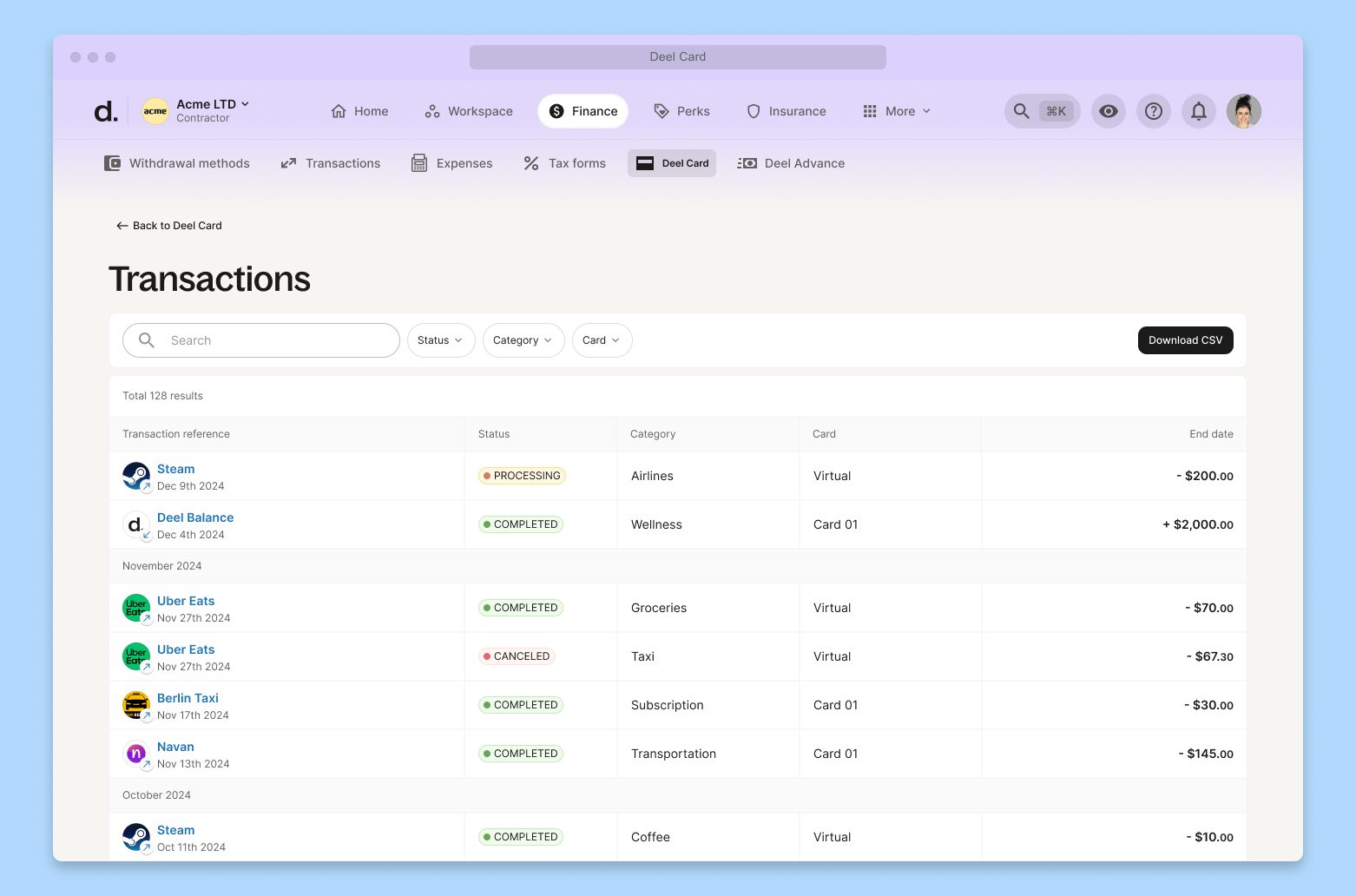

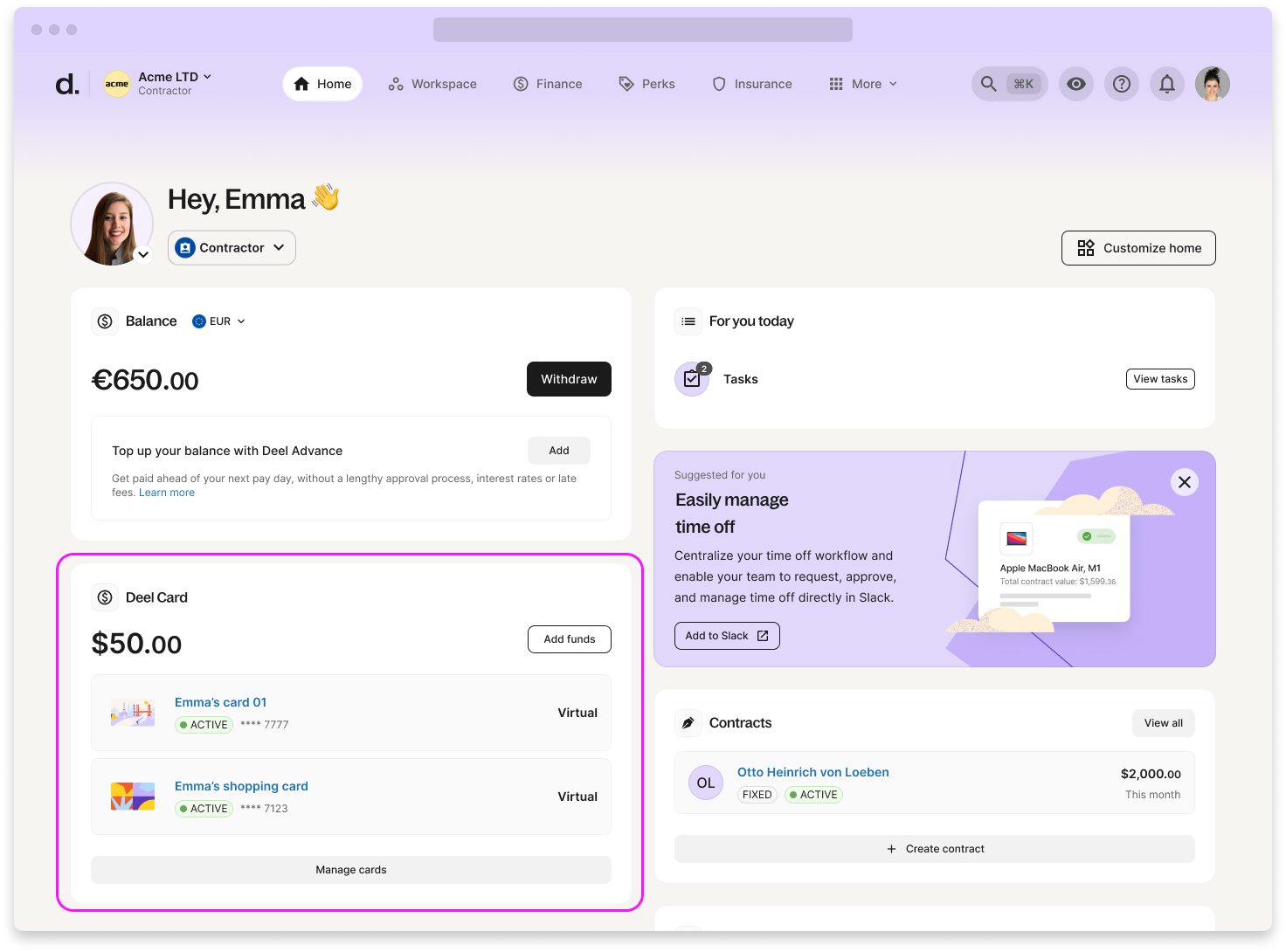

For the Card, I added prominent homepage banners and a dedicated widget that let users check balances and take quick actions without navigating deep menus. I redesigned the main Card screen to highlight spending insights, enabled multi‑card creation for separate budgets, and introduced CSV export for better record‑keeping.

Deel Card widget helps manage cards from the dashboard

Flexibility was a key theme. I removed the “one‑advance‑per‑month” limit, allowed advances in the contractor’s pay currency, and built automated eligibility alerts. On the Card side, I supported multiple cards per user, paving the way for future cash‑back features and seamless top‑ups via Advance.

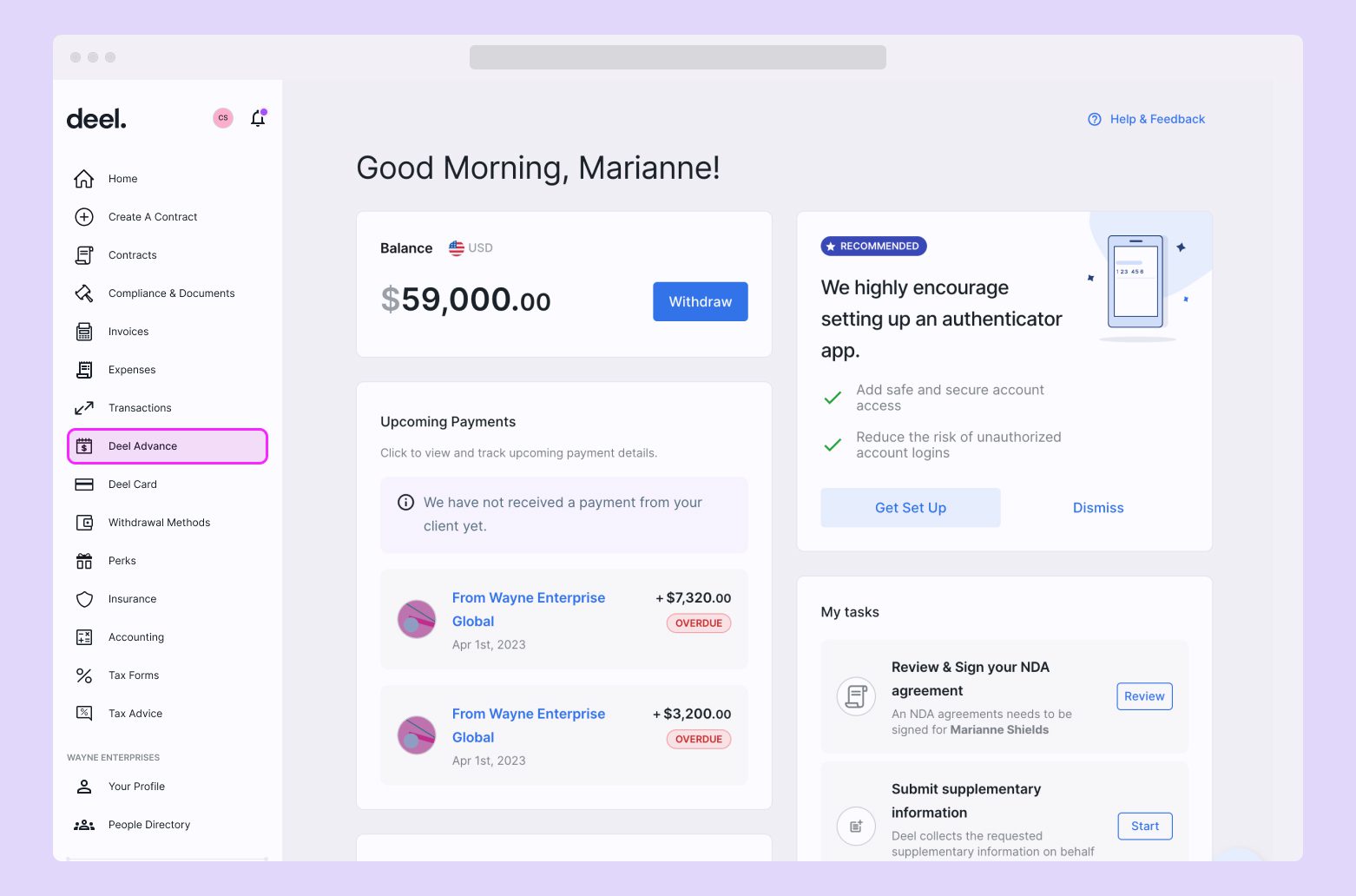

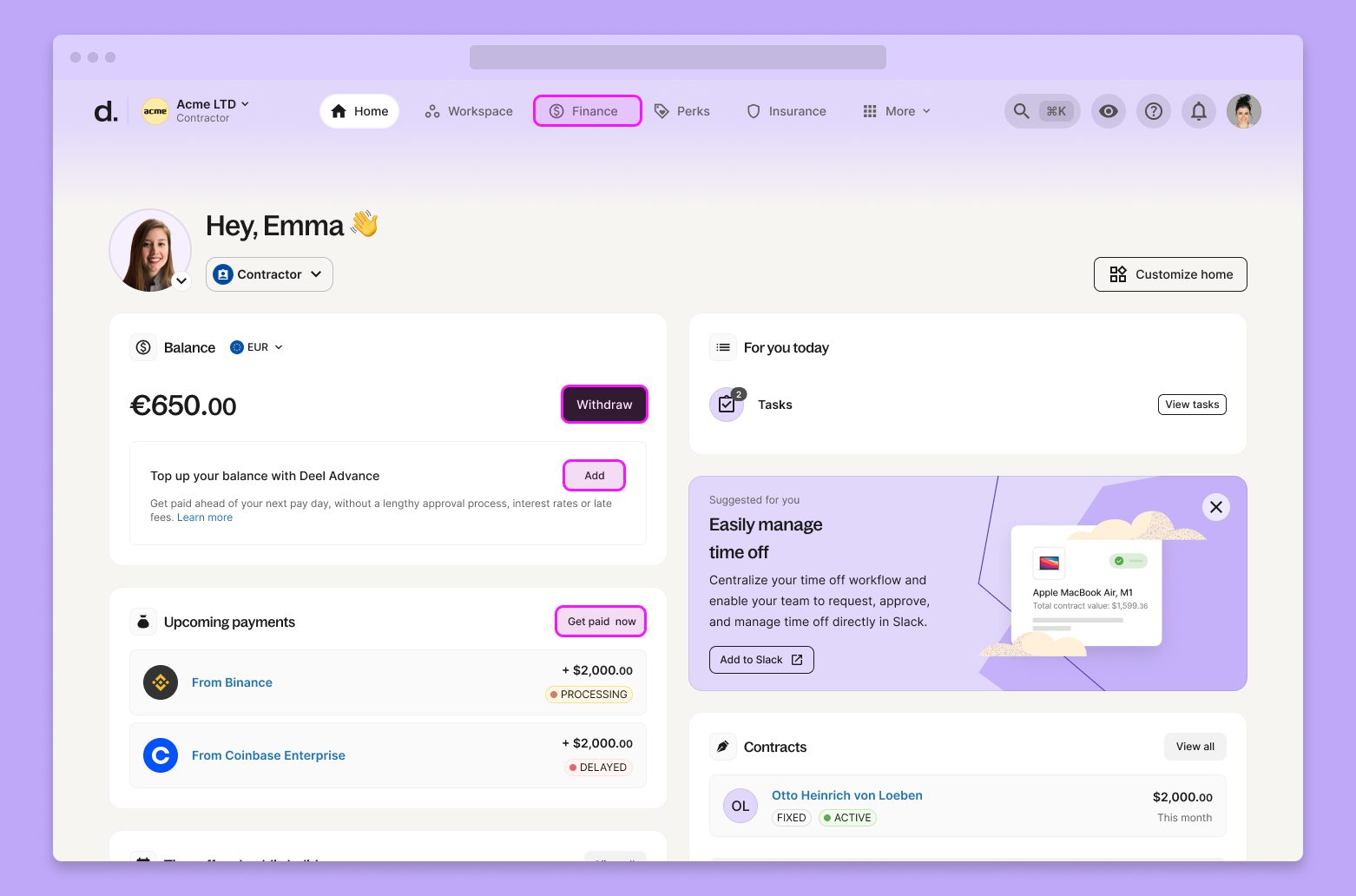

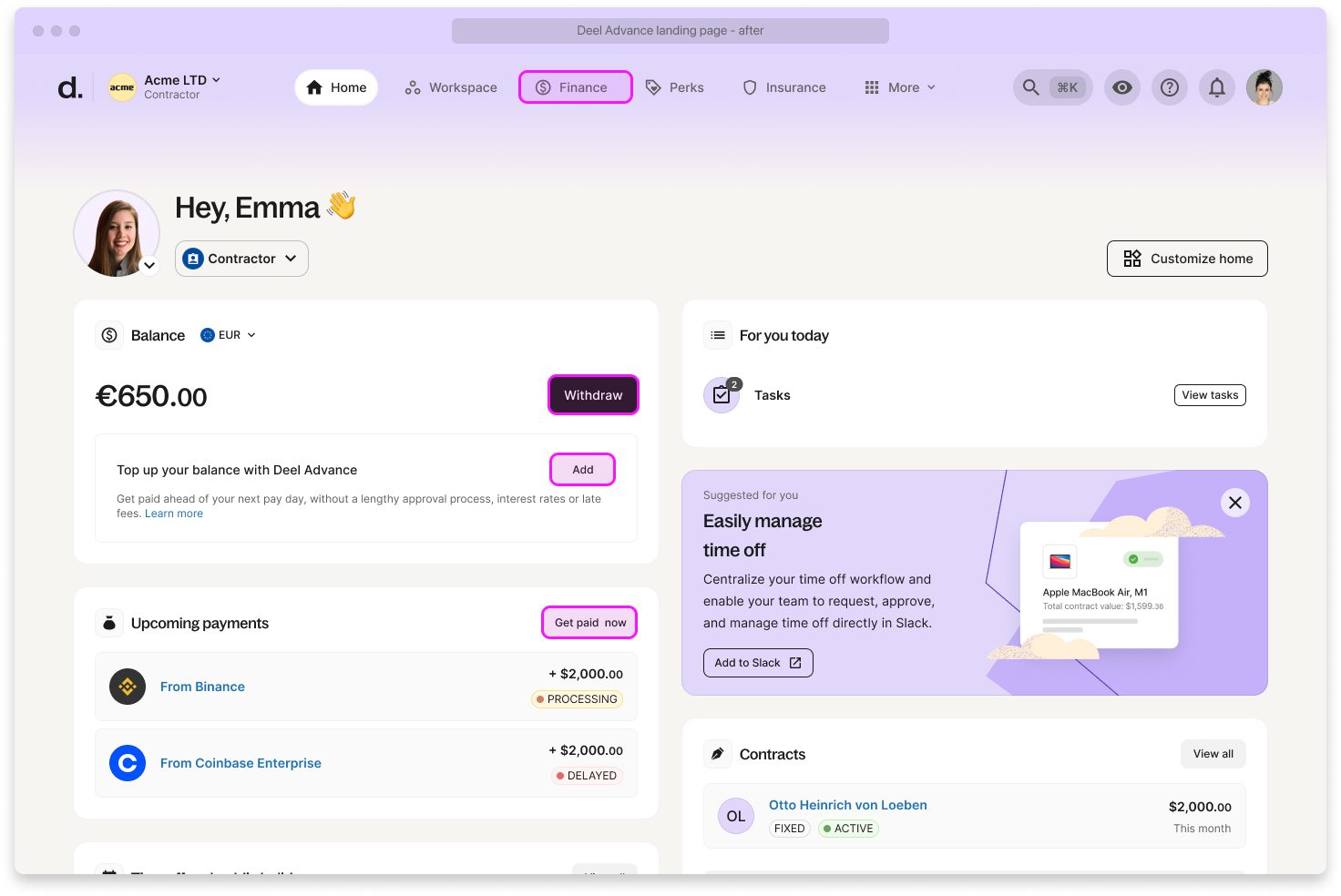

Visibility was improved by placing new entry points in high‑traffic areas—home screen banners, the withdrawal flow, upcoming‑payment screens, and eventually the balance widget when the home page became crowded. This made the features impossible to miss and drove immediate usage spikes.

New entry points to Deel Advance increased discoverability

To cut support load, I added contextual in‑app FAQs and rolled out educational email sequences that explained fees, eligibility, and how to finish partially started flows. Clearer communications dramatically reduced repetitive tickets.

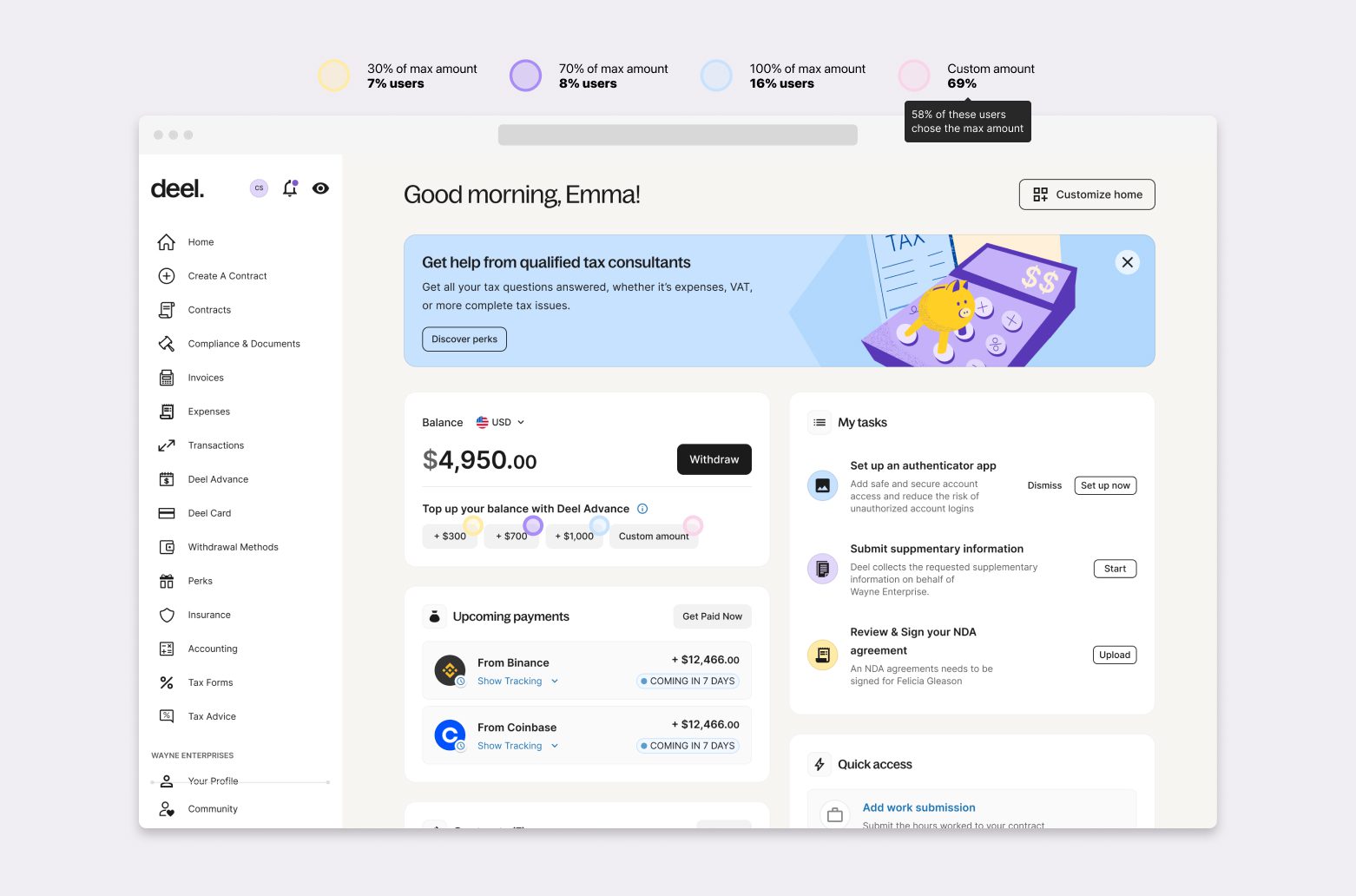

Finally, I ran experiments to validate ideas. An automated‑advance trial failed, teaching that contractors value control. A successful test offered predefined amount options (30 %, 70 %, 100 %) plus a custom field; most users chose the custom amount and took the full available balance, confirming the need for control.

Through this research‑driven, simplification‑first approach, I turned two under‑used features into essential, revenue‑generating tools that contractors trust and rely on.

During my time at Deel I also worked on Anytime Pay, and Expense Cards.

—Gallery

©2025 Daniel Carrasco Lara. Some rights reserved.