Deel Advance overhaul

4 minutes · Deel · 2023 – Present · Product Designer

Numbers first

- Monthly revenue increased by 229% in six months

- Active users increased by 96% after we added more entry points

- 85–90% of users came back every month

- Multiple Advances added 6.5% revenue in just weeks

- Homepage CTA brought 13% more users and became the top entry point to take Advances

- Fewer support tickets

The problem: Independent contractors can’t always rely on a steady income

Imagine being a contractor waiting for a client to pay you. The rent is due or the car broke down, but you paycheck won’t arrive for another two weeks. What do you do? This is the problem Deel Advance solves—a way for contractors to get paid early without interest or credit checks. Deel has offered this service for a time, but not enough people were using it. Those who did often ran into confusion or frustration.

What was going on?

- Too many steps: Taking a Deel Advance felt like applying for a loan, not just withdrawing money

- Unclear fees: People didn’t understand how much they’d owe back

- Only one Deel Advance per month: A small amount early in the month, locked the feature until the next payday

- Nobody knew about it: Deel Advance was buried in a myriad of features and services

- Too many support tickets: Contractors kept asking the same questions over and over

Understanding the users

We did user research with contractors to find out their problems, needs, and wants. We identified six main types of personas, but all shared the same needs

1 - “I need cash now for an emergency”

2 - “I get paid irregularly, so I need help smoothing out my income”

3 - “I don’t want to jump through hoops, just let me get my money fast”

Most people were using Deel Advance to cover real, sometime urgent, expenses. They relied on that, and we wanted to make it better.

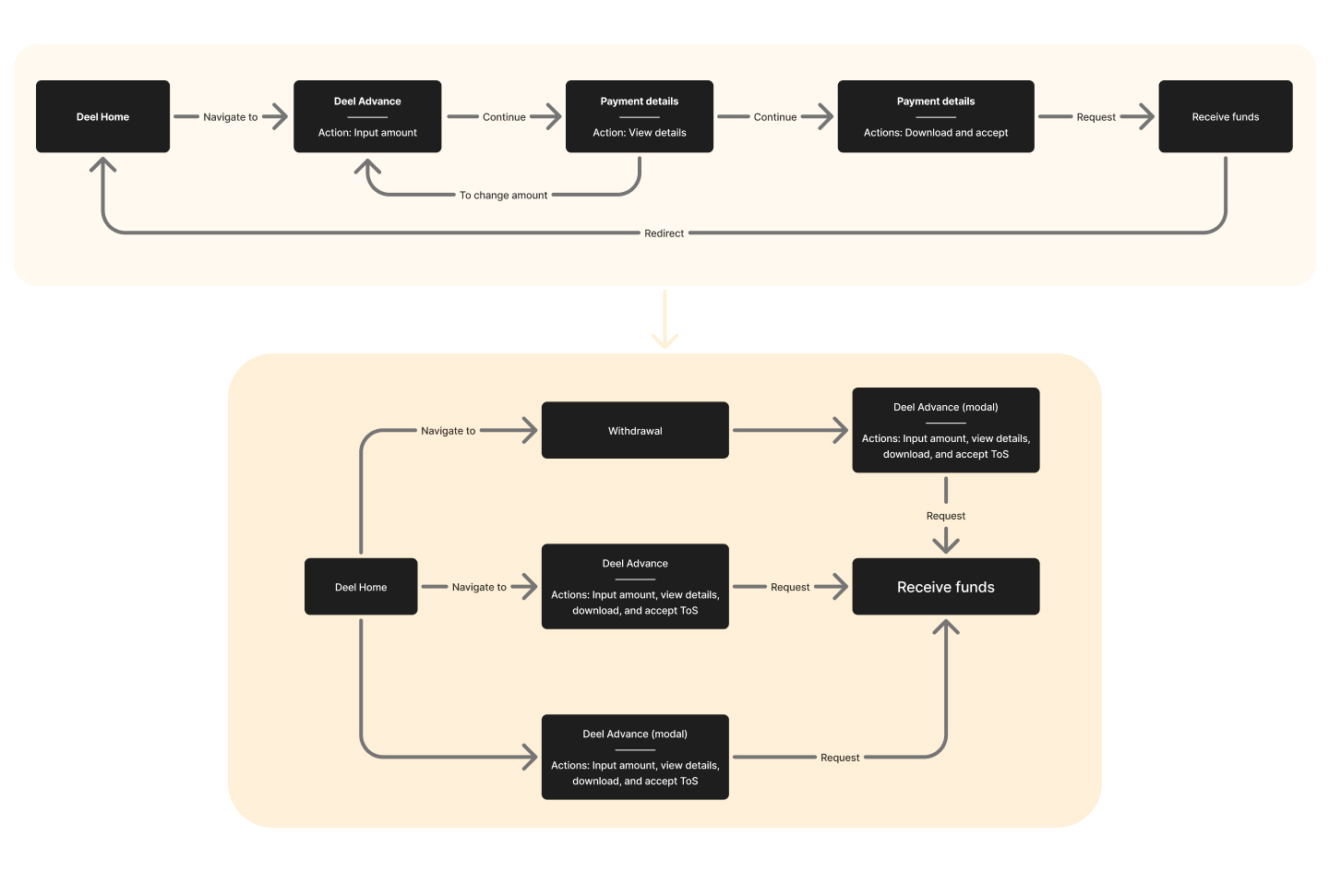

Above: old flow to get a Deel Advance. Below: new, shorter flows to get Deel Advance

How we fixed it: we made it simpler

- Fewer steps: We cut down the process so it felt more like withdrawing cash from an ATM

- Clearer fees: Instead of hiding the costs, we showed exactly what people would pay upfront

- Deel Advance inside other flows: If someone was already withdrawing money, they could take a Deel Advance right there without being redirected

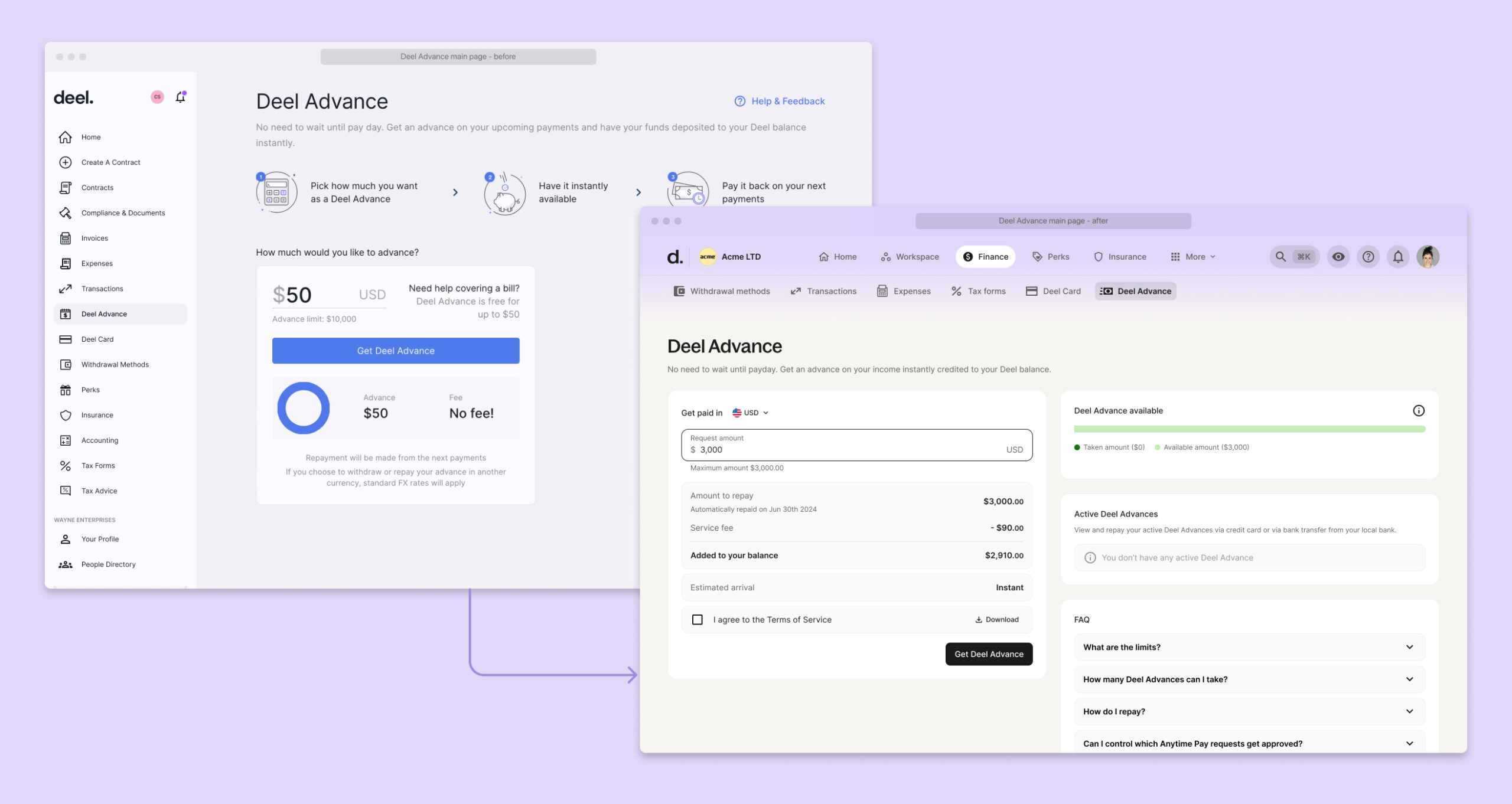

Back: old Deel Advance screen. Front: new Deel Advance screen with currency selector, available amount, tracking of active advances, and FAQs

We made it more flexible

- Multiple Advances per month: No more getting ‘locked out’ after one small Advance

- Different currencies: If contractors get paid in Euro, they can take an Advance in Euro, not forced to withdraw USD anymore

- Automatic eligibility alerts: If ICs couldn’t use Deel Advance at first, we’d notify them as soon as they could.

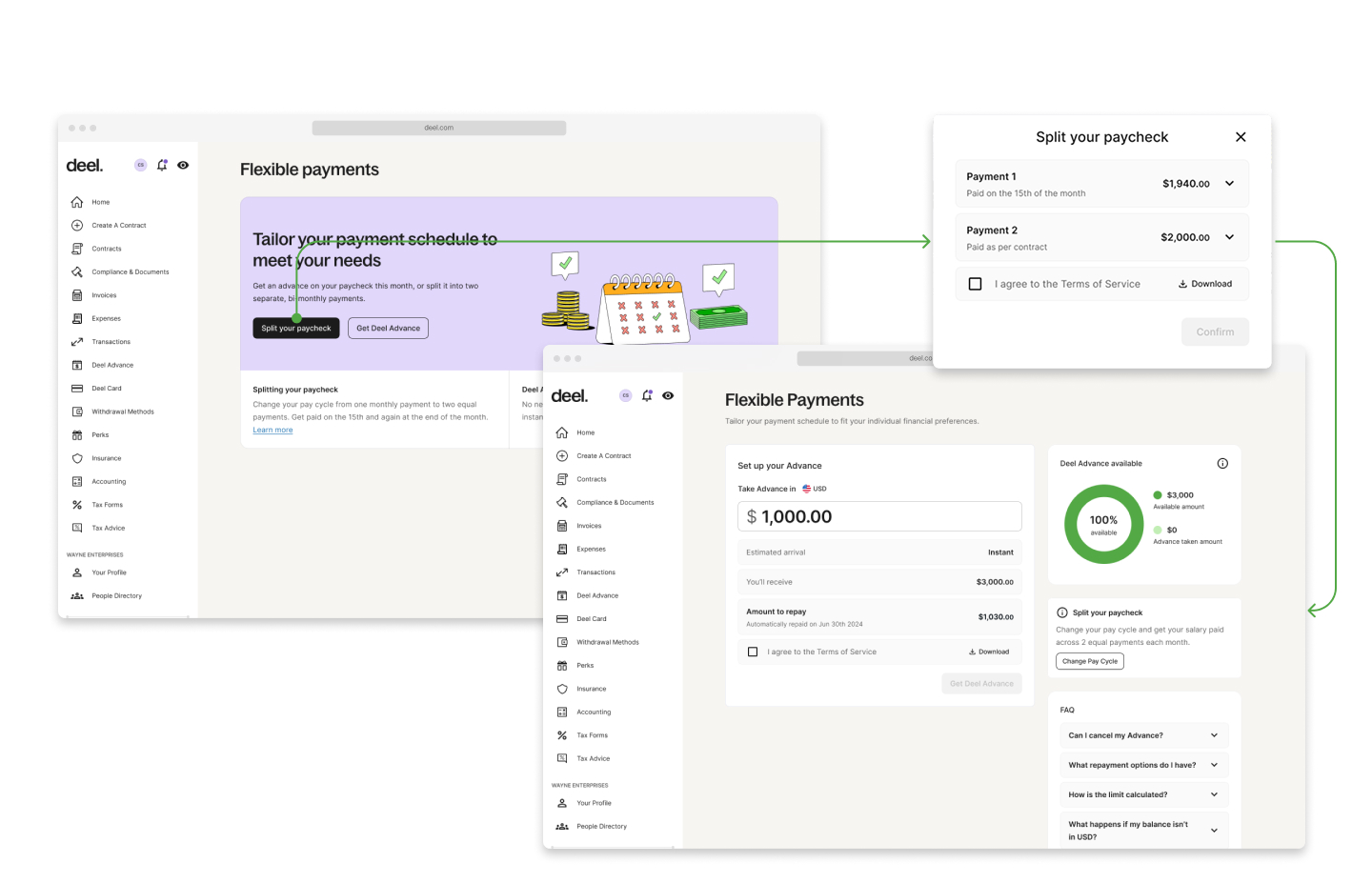

Back: old entry point. Front: new multiple entry points to Deel Advance

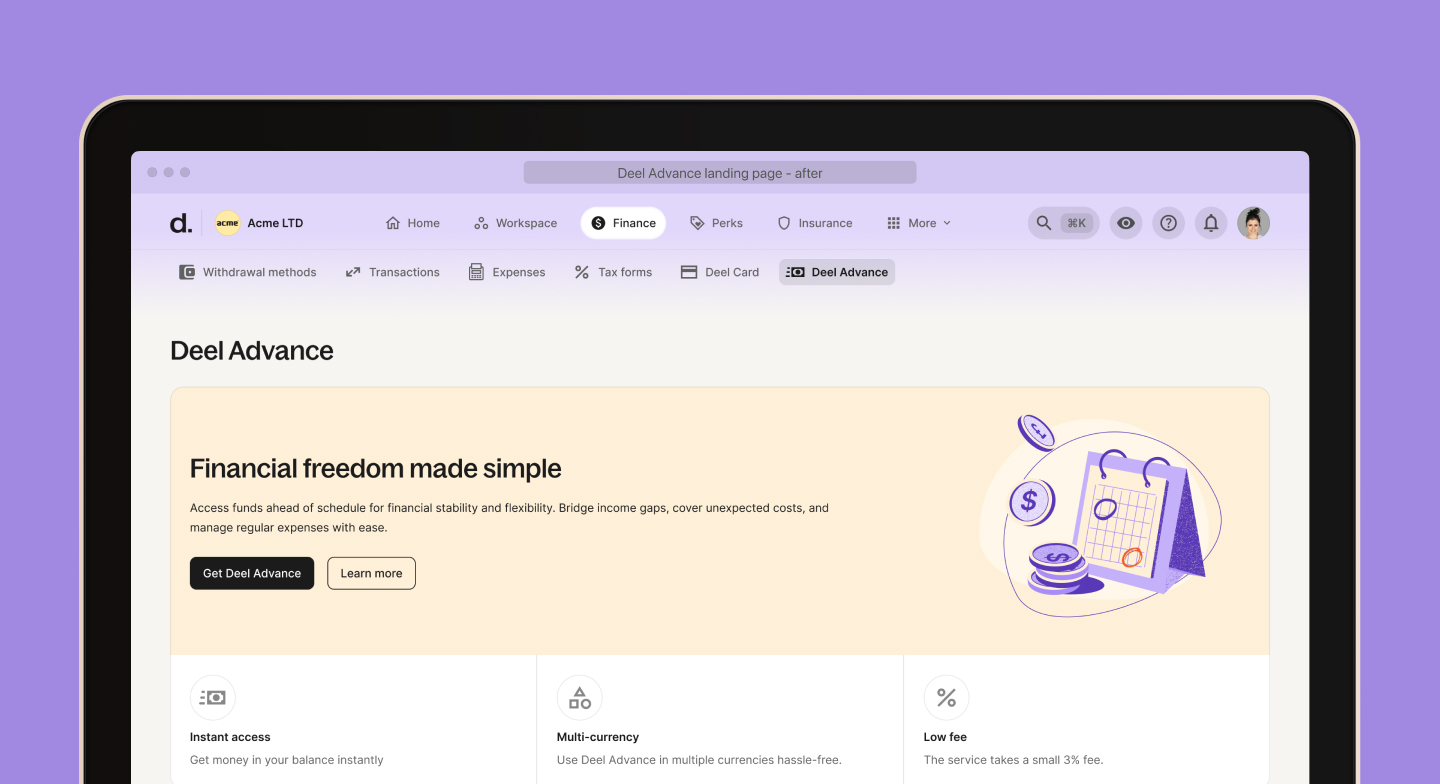

We made it impossible to miss

- New entry points: We added banners in key places (home screen, withdrawal flow, and upcoming payments)

- Balance box integration: When the homepage got too many banners, we moved the Deel Advance banner to be an option directly into the balance widget. Usage went up immediately!

We cut down on support tickets

- In-app FAQs: Answers appeared right where people needed them

- Educational emails: We explained how it worked and reminded people who started the flow but didn’t finish it

Test: Deel Advance renamed to Flexible payments, and Split your paycheck modules in Deel Advance screen

We experimented (and we learned)

One failed experiment was automated Advances—under another name—where half the available money came at the start of the month and half mid-month. Almost nobody used it. Lesson learned: Contractors want control.

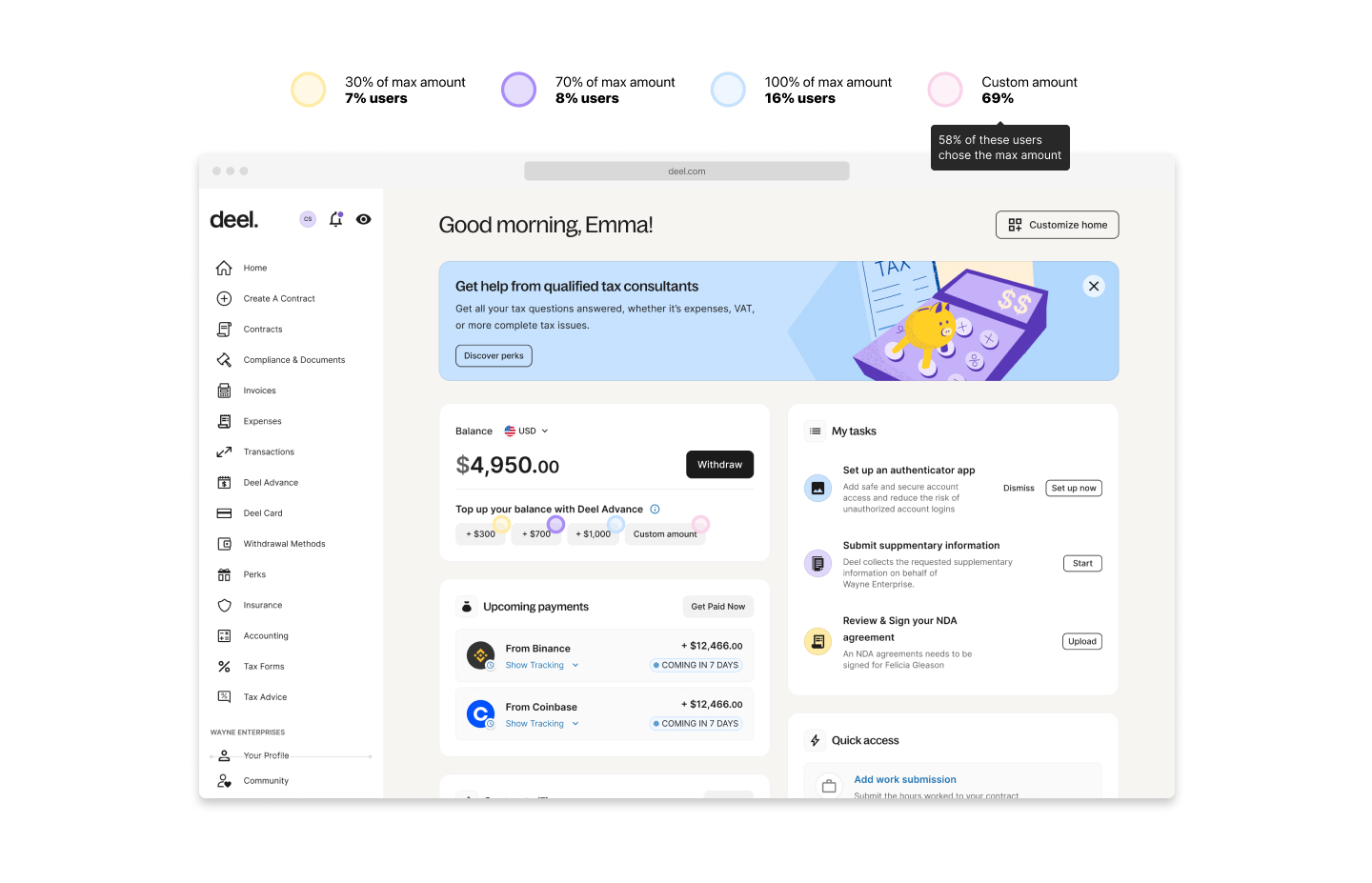

User share of Deel Advance entry points

The second experiment enforced the lesson learned at first. We offered pre-defined amount based on our analytics of most used, 30, 70, and 100%. As well as a ‘custom amount’ option. Most contractors selected ‘custom amount’ and then took 100% of available funds.

The lesson learned

The best financial products don’t feel like financial products, they just feel like help. By cutting steps, adding flexibility, and putting the feature where people need it, we turned Deel Advance into something contractors actually use, and rely on.

Final result? Happier contractors, fewer headaches for our team, and a product that keeps growing.

daniel.cl@pm.me | ©2025 Daniel Carrasco Lara. Some rights reserved.